DD 2558 1996 free printable template

Show details

AUTHORIZATION TO START, STOP OR CHANGE AN ALLOTMENT PRIVACY ACT STATEMENT AUTHORITY: 37 U.S.C., E.O. 9397. PRINCIPAL PURPOSE: To permit starts, changes, or stops to allotments. To maintain a record

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DD 2558

Edit your DD 2558 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DD 2558 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DD 2558 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DD 2558. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DD 2558 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DD 2558

How to fill out DD 2558

01

Obtain a copy of DD Form 2558 from the appropriate military or government website.

02

Fill out the 'Identification Data' section, providing personal information such as name, Social Security Number, and date of birth.

03

In the 'Address' section, enter your current mailing address.

04

Complete the 'Type of Payment' section by selecting the appropriate method for payments.

05

If applicable, fill out the 'Banking Information' section with your bank account and routing numbers.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom to certify the information provided is accurate.

08

Submit the completed DD Form 2558 to the designated military finance office.

Who needs DD 2558?

01

Service members who wish to authorize electronic payment for military pay, allowances, or other entitlements.

02

Dependents or beneficiaries who need to receive entitlements or payments from a service member.

03

Veterans applying for benefits that require payment instruction changes.

Fill

form

: Try Risk Free

People Also Ask about

How do you set up an allotment?

Allotments may be set up through myPay or by using DD Form 2558. When you set up an allotment through myPay, you will see a “no later than” date listed before and after you set up the allotment. This lets you know whether the allotment will start this month or next month.

Where do you put an allotment?

A good allotment plot should have plenty of sunlight, nearby access to water, a shed and land that can be worked for planting.

What is an allotment type?

There are two types of allotments: discretionary and non-discretionary. You can have up to six discretionary allotments per month, and any number of non-discretionary allotments, as long as the total allotments per month is 15 or less. Your allotment is evenly divided between your semimonthly paychecks.

What is an allotment on my pay?

"Allotment" means a recurring specified deduction for a legal purpose from pay authorized by an employee to be disbursed on a pay period basis to an allotee.

What are the best allotment ideas?

Allotment Ideas Set up a tool storage solution. If space allows, you'll need a structure to house your garden tools securely. Consider companion planting. Rooftop allotments. Planting station for the kids. Welcome more wildlife. Paths between beds. Go for water butts. Make your own compost.

What is a military allotment?

Allotments are payroll deductions, and a way to pay for things directly from your paycheck – before you see the money. Most people use them to pay for things like life insurance or repaying a military loan. DoD won't let you set up allotments to pay for things like vehicles, furniture, electronics, and jewelry.

What can I use an allotment for?

Whether you are interested in gardening, growing, cooking or indeed eating, tending an allotment is ideal. You can grow a range of fruits, vegetables and herbs for the kitchen, and even grow ornamental plants for a productive and attractive plot. See if you can designate a piece of your garden to growing crops.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in DD 2558?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your DD 2558 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit DD 2558 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign DD 2558. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit DD 2558 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute DD 2558 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is DD 2558?

DD Form 2558, also known as the 'Authorization to Start, Stop or Change Basic Allowance for Housing (BAH),' is a form used by military members to request changes to their housing allowance.

Who is required to file DD 2558?

Military personnel who need to initiate, modify, or terminate their Basic Allowance for Housing (BAH) must file DD Form 2558.

How to fill out DD 2558?

To fill out DD Form 2558, provide personal identification details, specify the changes to BAH, and include relevant dates and signatures as required.

What is the purpose of DD 2558?

The purpose of DD Form 2558 is to formally document a service member's request for changes to their housing allowance for administrative purposes within the military.

What information must be reported on DD 2558?

Information that must be reported on DD Form 2558 includes the service member's personal details, current and desired housing status, effective dates for changes, and the reason for the request.

Fill out your DD 2558 online with pdfFiller!

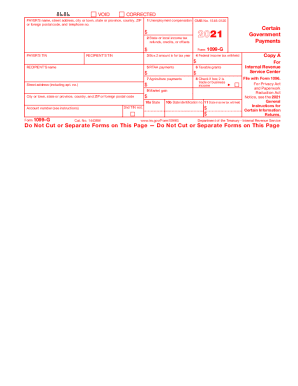

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DD 2558 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.